customer success story

FinWise achieves strategic expansion dynamic growth operational efficiency

FinWise Bank (FinWise), a subsidiary of FinWise Bancorp, is an equipment finance lender that specializes in industrial equipment for tow and recovery, transportation vehicles, and construction. As part of its expansion strategy, FinWise wanted to expand their footprint and enter the equipment finance industry nationwide.

challenge

FinWise recognized the need for a strategic fintech partner with expertise in equipment finance and the ability to deliver an automated salesforce Loan Origination System (LOS) solution that could meet their business goals.

- decrease credit adjudication turn times

- expand business offerings nationwide

- enhance operational efficiency

- maintain compliance with regulatory requirements

solution

FinWise chose to implement northteq’s aurora platform, a comprehensive solution tailored to fit FinWise’s unique needs.

efficient credit adjudication

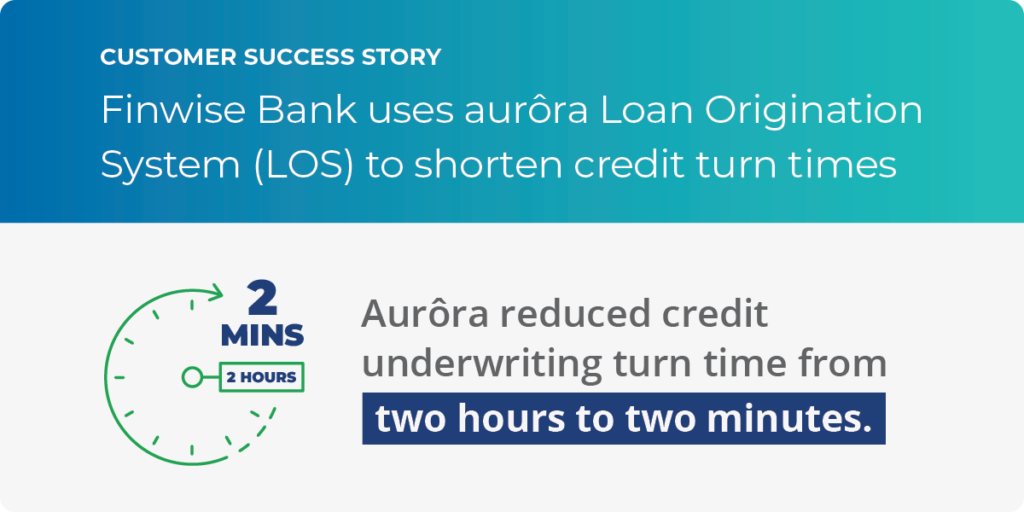

By leveraging the capabilities of aurora, FinWise was able to reduce credit underwriting turn time from two hours to two minutes. The solution automated the process, which eliminated manual touchpoints and accelerated decision-making.

customized automated workflows

Aurora enabled workflows that were customized to FinWise’s unique equipment finance lending process. This included the implementation of a

no-touch credit approval process, adding compliance and regulatory requirements, and creating a white-labeled partner portal.

scalable

solution

Designed to scale and adjust for future business growth, aurôra is a solution capable of supporting FinWise’s expansion for years to come.

compliance integrations

Aurora included the necessary regulatory audit trail to ensure compliance with industry regulations. Automated decisions within the credit underwriting workflows were documented, helping FinWise maintain transparency and follow regulatory requirements.

We trusted northteq from the beginning. We were able to work collaboratively together to build a sustainable solution that will scale and grow with our business for years to come.

— CHRIS MORELL, VP, EQUIPMENT FINANCE, FINWISE BANK

It’s humbling and inspiring to see the impact our work has already had on the FinWise team. Their focused investments in technology not only provide a thoughtfully designed, enhanced user experience, but also transforms how quickly they do business.

— KRISTIAN DOLAN, CEO, NORTHTEQ

business impact

The successful integration and launch of aurora enabled FinWise Bank to achieve significant improvements and growth.

faster turn times

A fully automated credit adjudication process now allows FinWise to complete credit reviews and approvals within two minutes.

extensibility for growth

Aurora is built on an extensible platform, which means it can be customized to fit FinWise’s specific business needs as they evolve.

automated innovation

Using the power of automation, aurora speeds up credit reviews and approvals. Plus, it gives borrowers, vendors, and employees real-time updates, providing transparency and clear visibility.

enhanced customer experience

By providing a smooth experience for borrowers, aurora helps turn them into happy, long-term customers who keep coming back.

innovative outlook

With aurora’s significant impact on automation, extensibility, and credit approval times, FinWise plans to continue to partner with nothteq to find innovative lending solutions as their business expands and develops.

“Partnering with northteq allowed us to increase efficiency and find a solution that works directly for our needs. As our business grows and changes, our portal solutions will need to change with it and partnering with northteq is exactly how we do that.”

— CHRIS MORELL, VP, EQUIPMENT FINANCE, FINWISE BANK