loan origination system

application to documentation in just 3 minutes on install

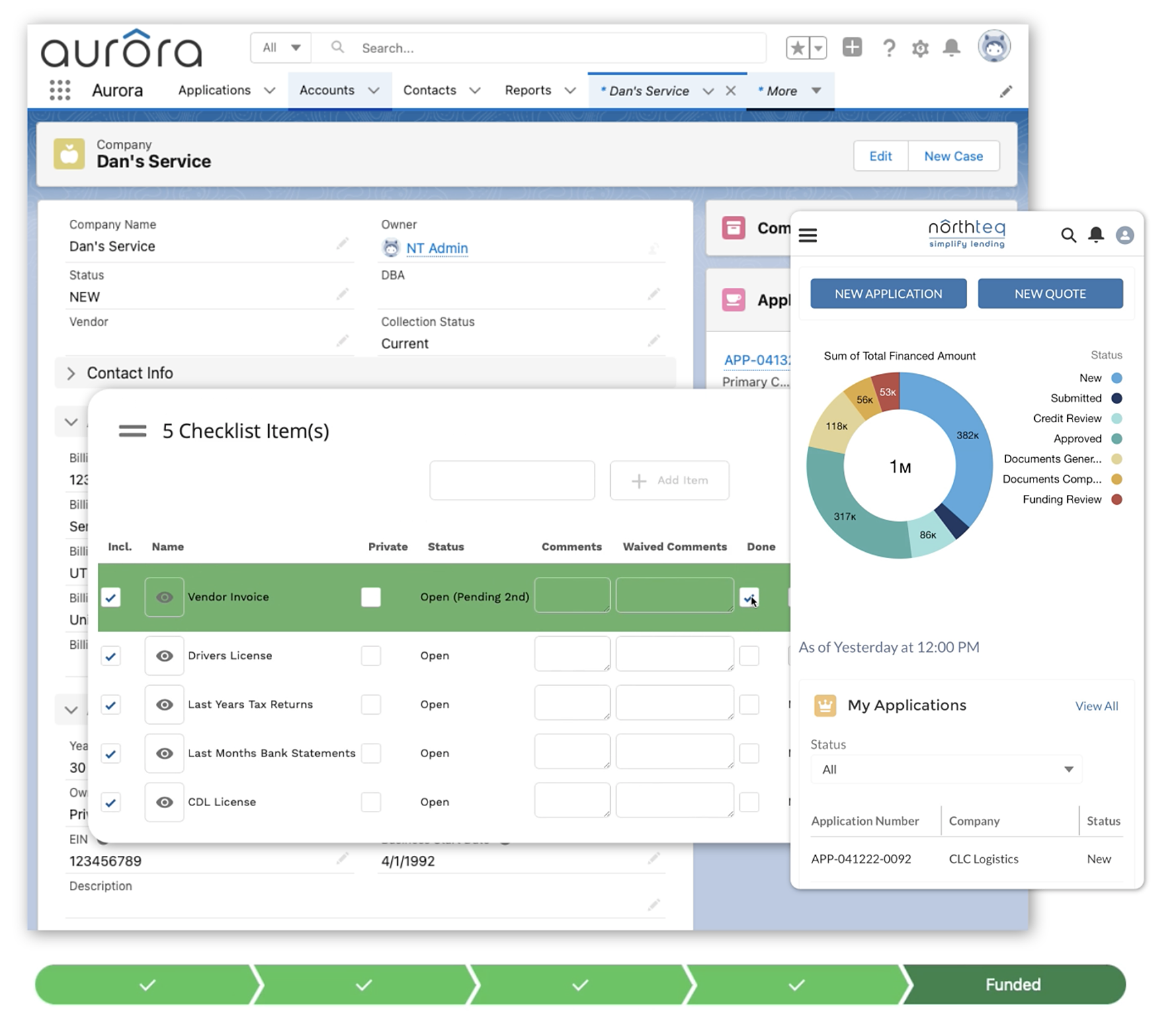

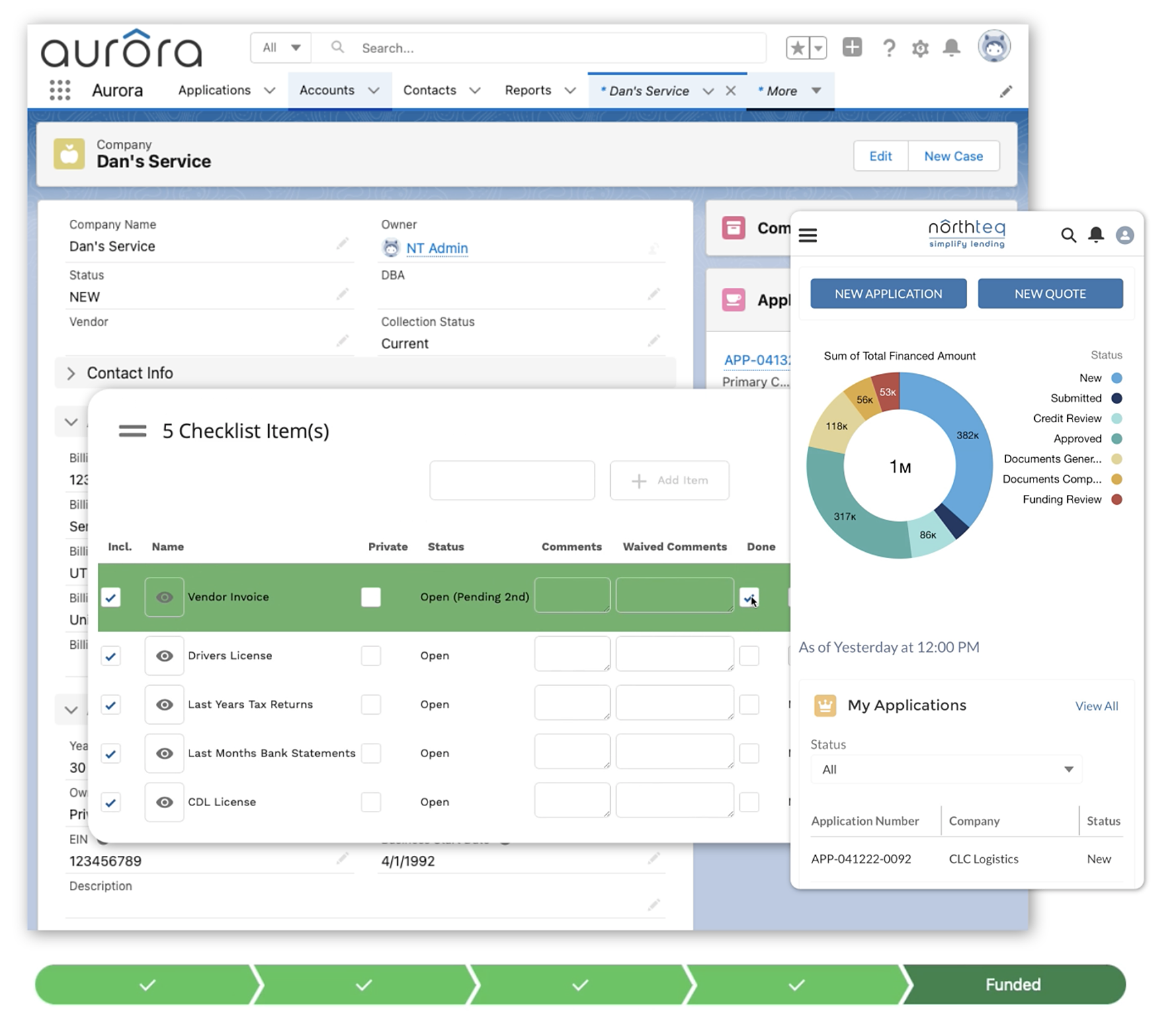

Aurôra’s automated end to end Loan Origination System (LOS) eliminates manual processes and disconnected workflows simplifying the way you originate, score, decision, and document your deals.

loan origination system

Aurôra redefines the way you originate leases/loans making lending easier than ever before.

Aurôra’s automated end to end Loan Origination System (LOS) eliminates manual processes and disconnected workflows simplifying the way you originate, score, decision, and document your deals.

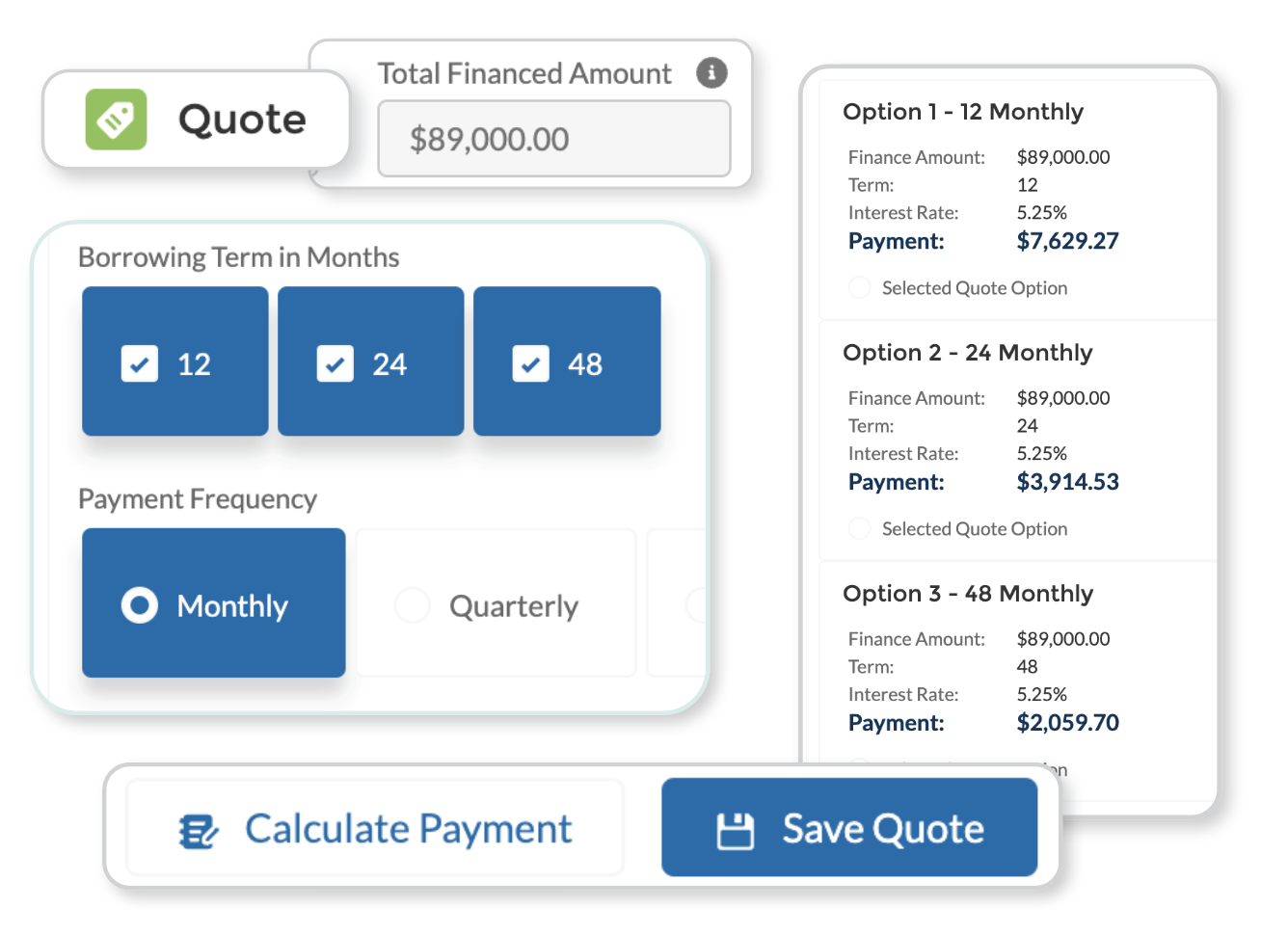

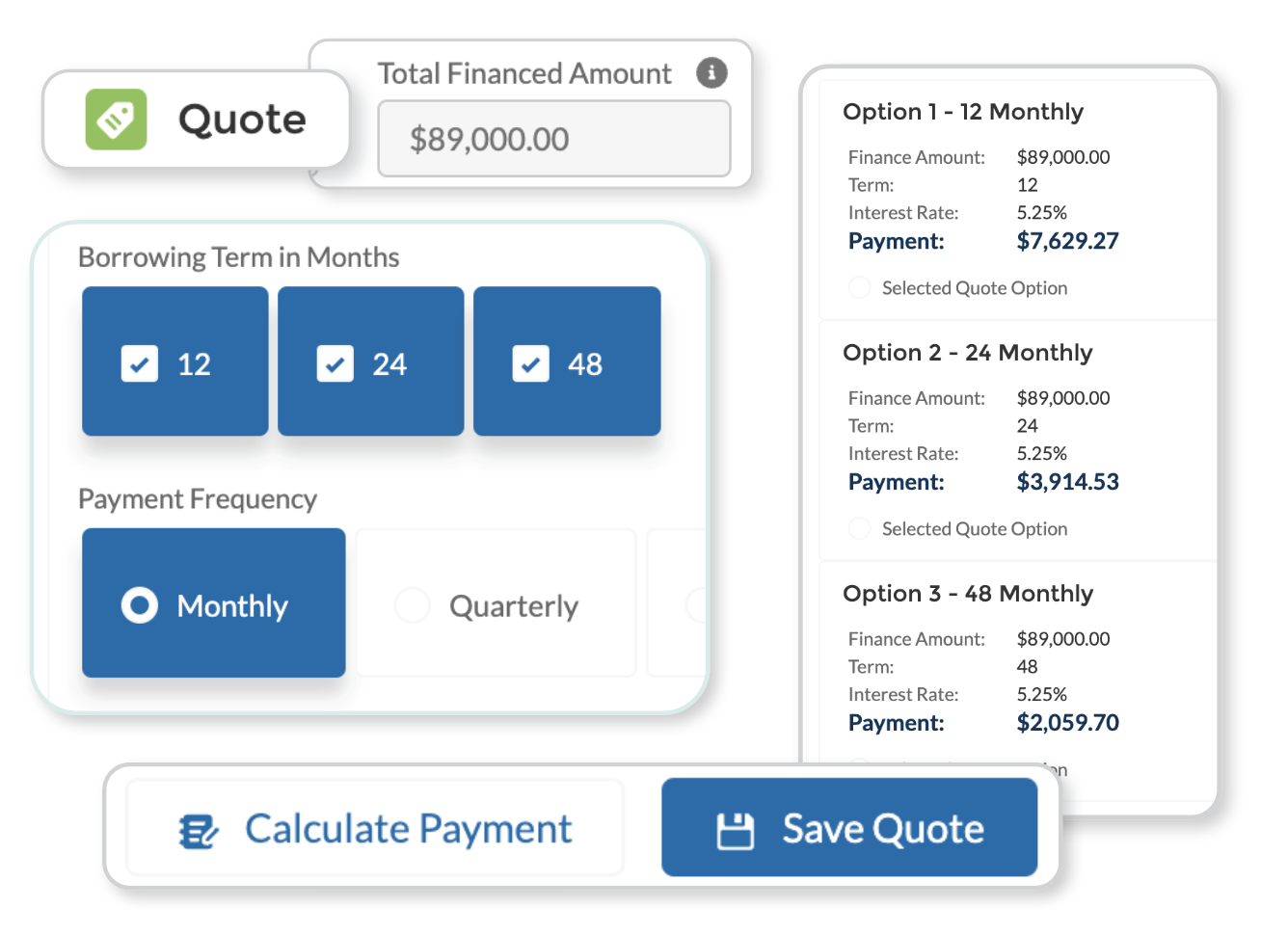

quote

quick and accurate quotes

risk based pricing

integrated rate card

generate instant quote letters

quote

quick and accurate quotes

risk based pricing

integrated rate card

generate instant quote letters

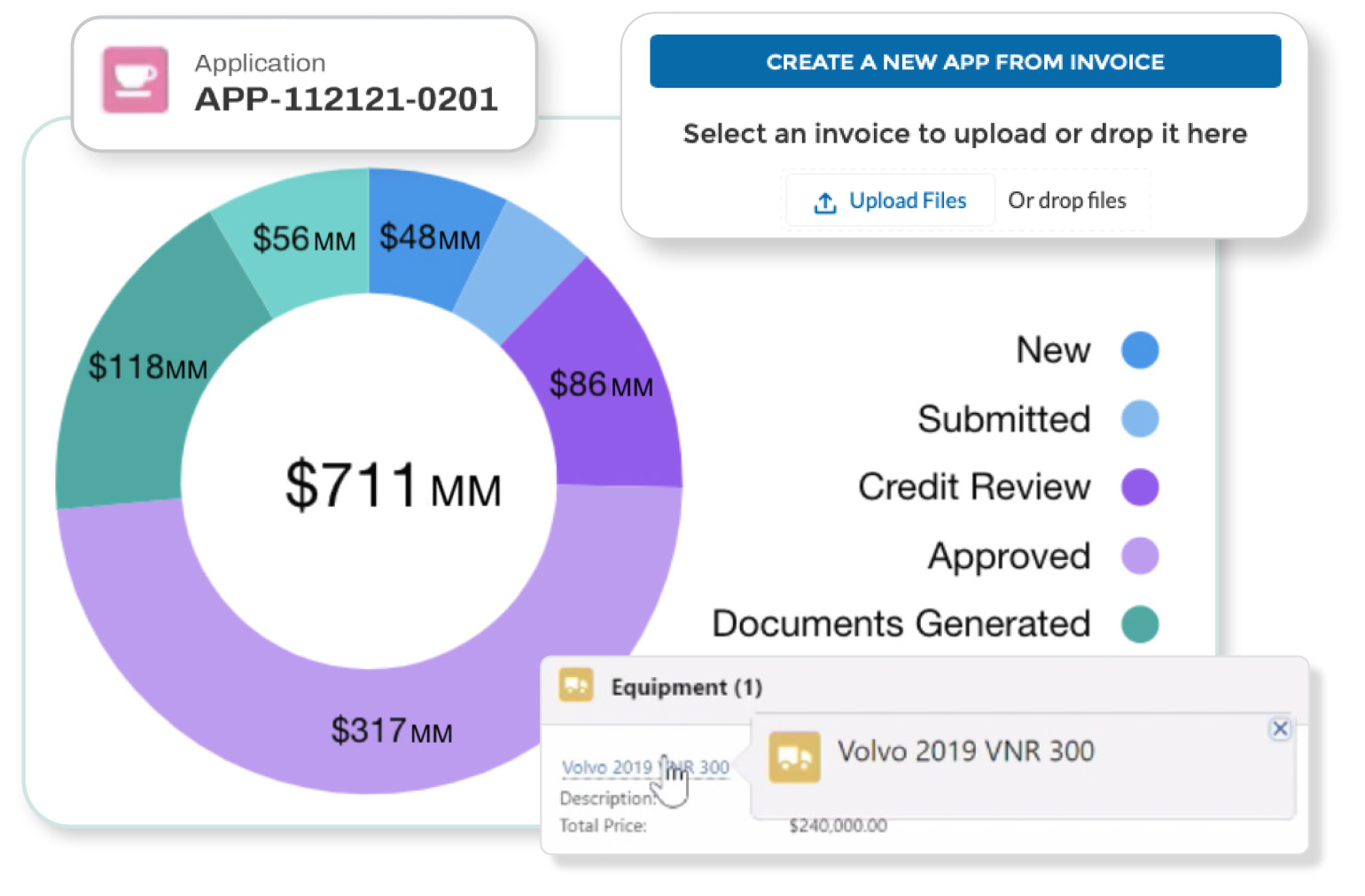

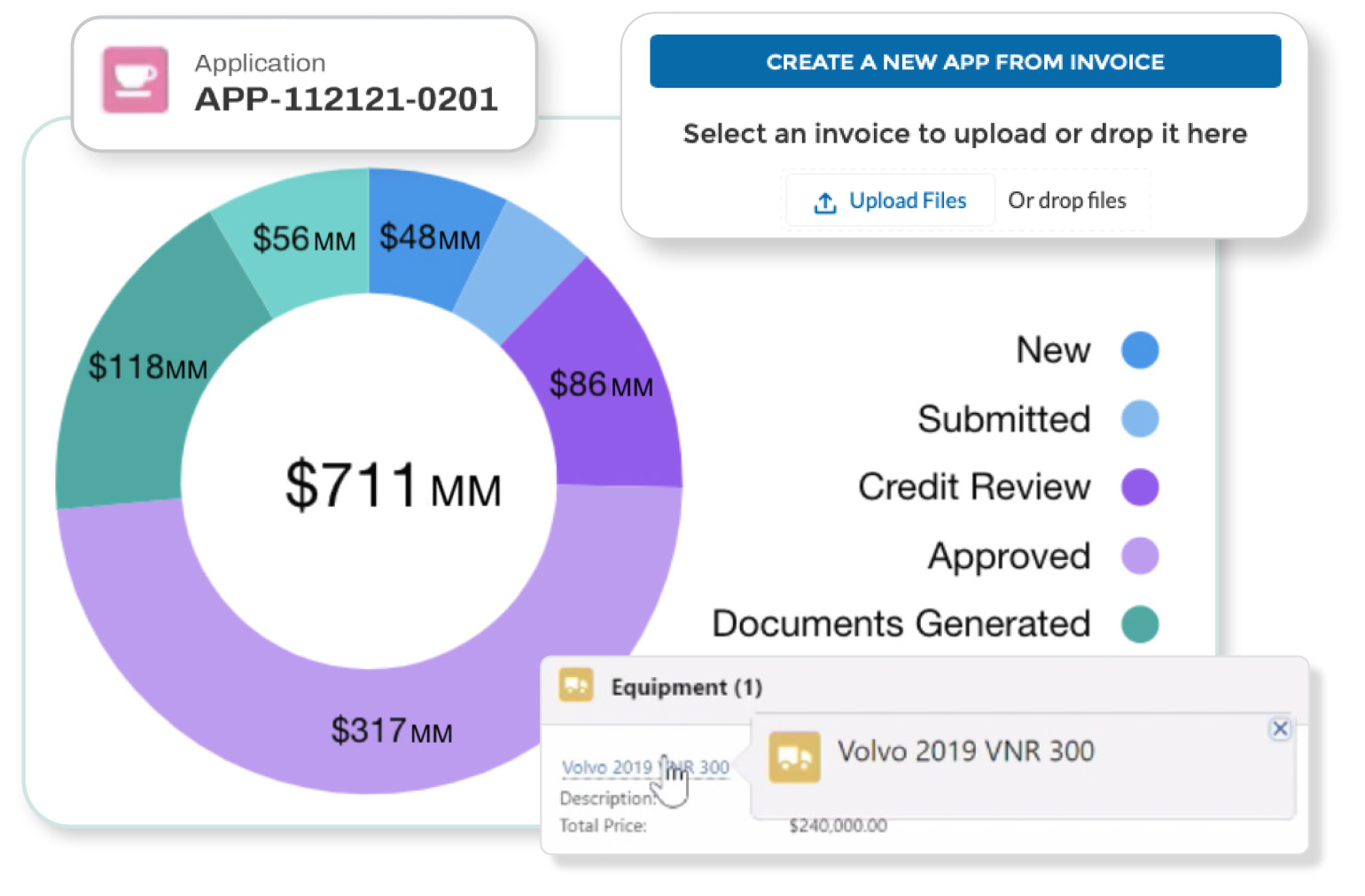

application

automate your process from the start

one click drag and drop for instant applications

intuitive, user-friendly application for customers & vendors

API enabled for powerful integrations

application

automate your process from the start

one click drag and drop for instant applications

intuitive, user-friendly application for customers & vendors

API enabled for powerful integrations

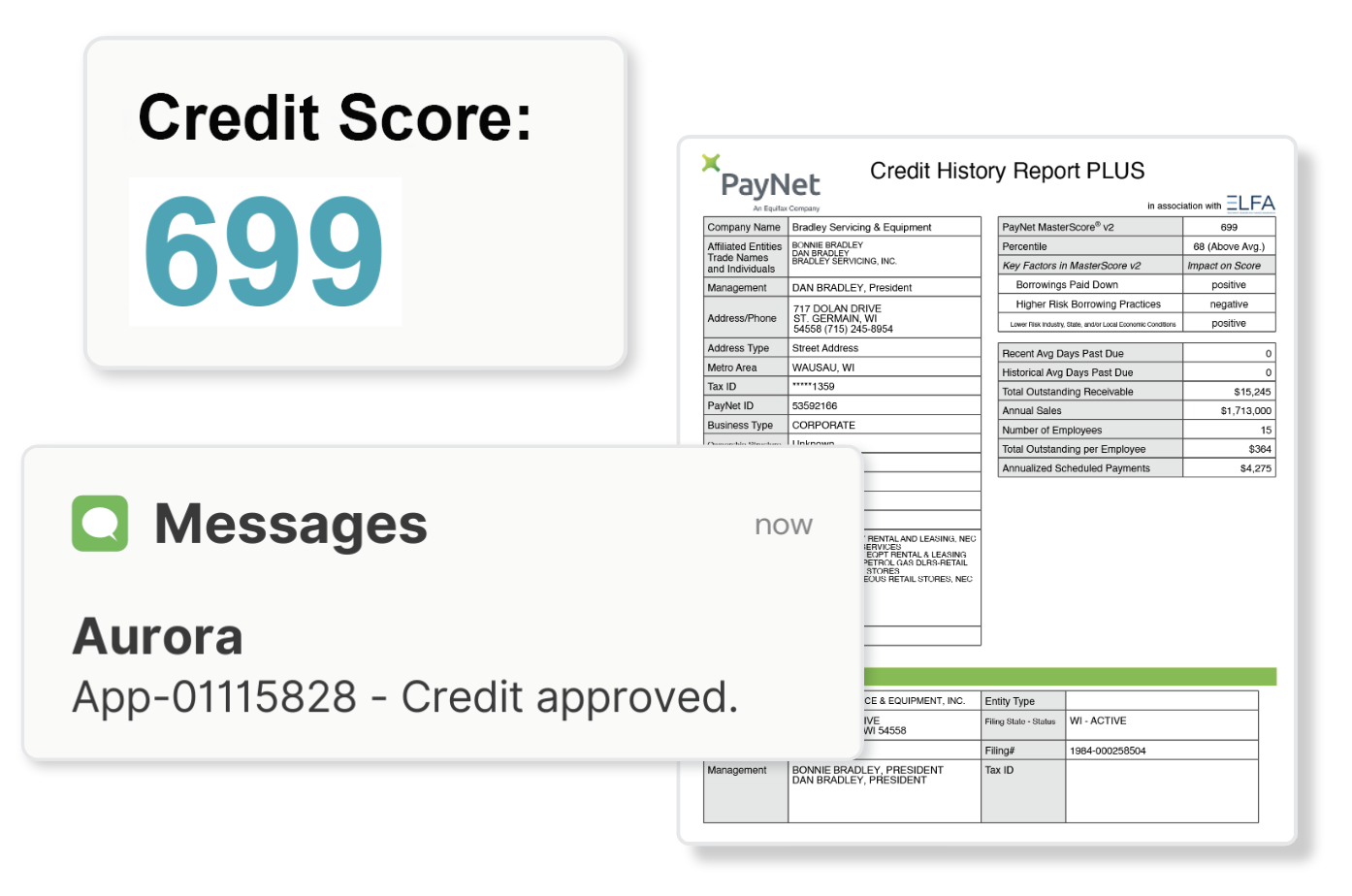

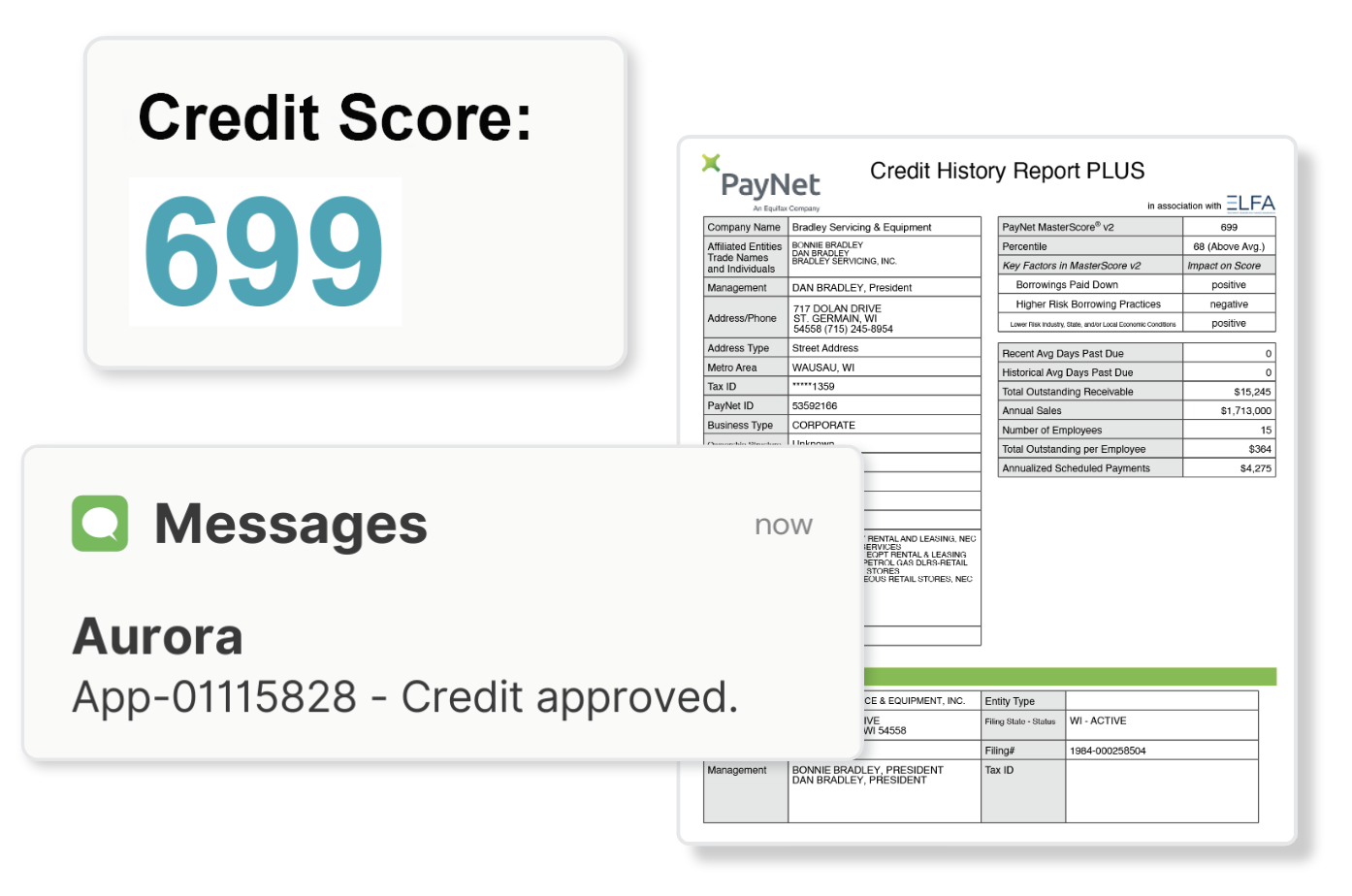

credit

fully automate your review and approval process

connect to advanced, unique fintech 3rd party data sources

integrate with any business or consumer bureau

auto-scorecards & decisioning

credit

fully automate your review and approval process

connect to advanced, unique fintech 3rd party data sources

integrate with any business or consumer bureau

auto-scorecards & decisioning

documents

automated document generation

eliminate data re-entry and human error

all major eSignature, eNotary, and eVaulting providers supported

quickly customize documents based on each customer’s unique needs

documents

automated document generation

eliminate data re-entry and human error

all major eSignature, eNotary, and eVaulting providers supported

quickly customize documents based on each customer’s unique needs

funding

turn opportunities into funded transactions faster

syndicate with any funding source

efficiently manage titles, UCC filings & searches

system-generated funding audit checklists

funding

turn opportunities into funded transactions faster

syndicate with any funding source

efficiently manage titles, UCC filings & searches

system-generated funding audit checklists

booking

seamlessly sync your systems

sync exposure and payment history between systems

ensure accuracy and integrity of customer data throughout the entire lending experience

integrate with dozens of core banking and servicing system

booking

seamlessly sync your systems

sync exposure and payment history between systems

ensure accuracy and integrity of customer data throughout the entire lending experience

integrate with dozens of core banking and servicing system

schedule a demo today

quick and accurate quotes

Vendors and team members can seamlessly generate multiple quote options in seconds

- risk based pricing

- structure simple or complex rates & terms

- integrated rate card – quickly deliver multiple options

- automated rule based rate cards

- flexible quoting templates

automate your process from the start

Aurora uses OCR drag & drop technology to automate the application process from the start, eliminating manual, outdated processes.

- API enabled for powerful integrations

- know your customers at every stage of the sales process

- external, intuitive, user-friendly application for customers & vendors

- typeless apps

- directly plug in with Salesforce CRM

expedite your credit process

Aurora’s research based user interface easily allows you to pull consumer and commercial credit reports, run a scorecard, calculate risk exposure, and analyze bank statements

- integrate with any business or consumer bureau

- built in credit checklists

- connect to advanced, unique fintech 3rd party data sources

- auto-scorecards – built in credit checklists & decisioning

- visual reporting for a one stop view of all credit data

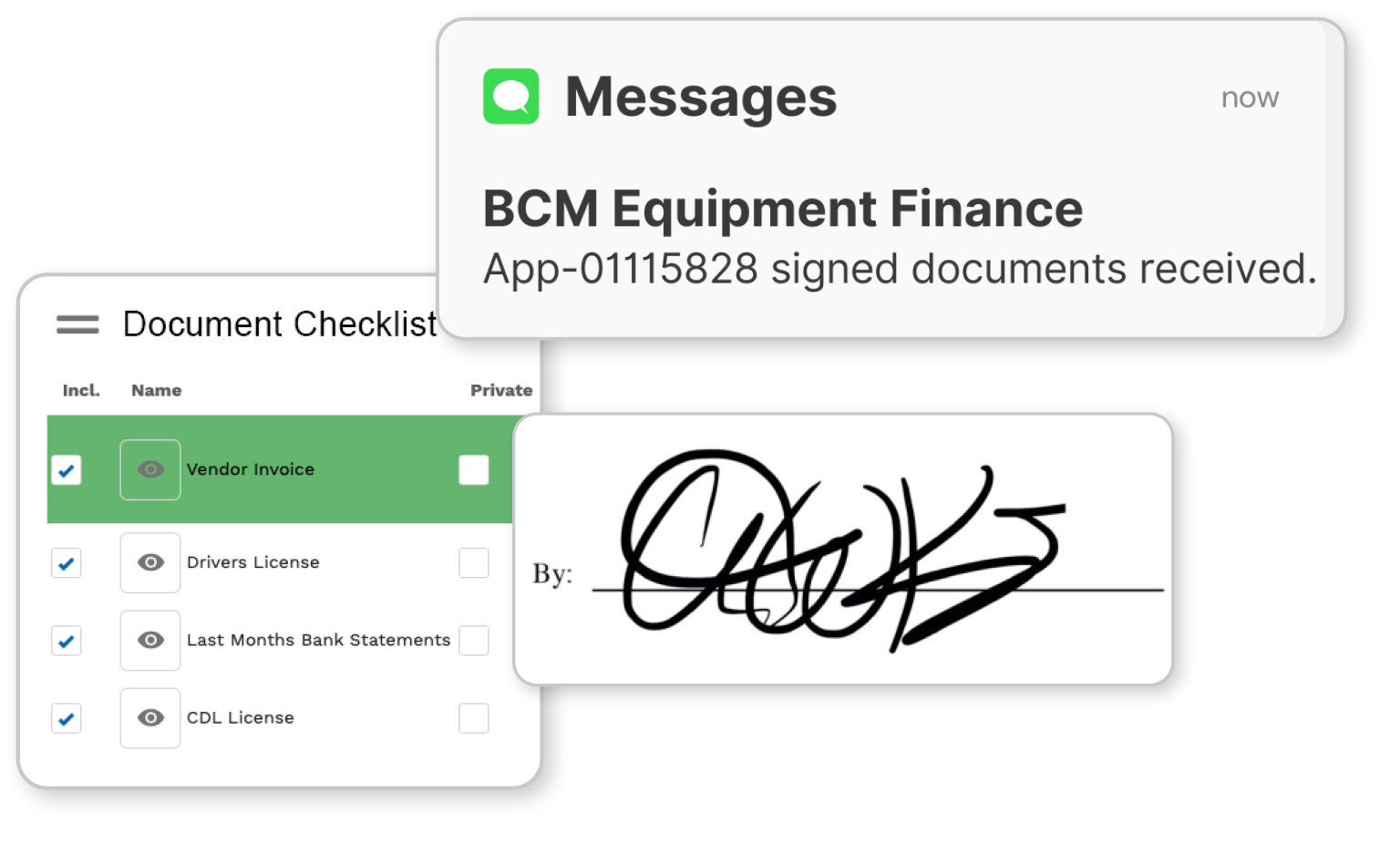

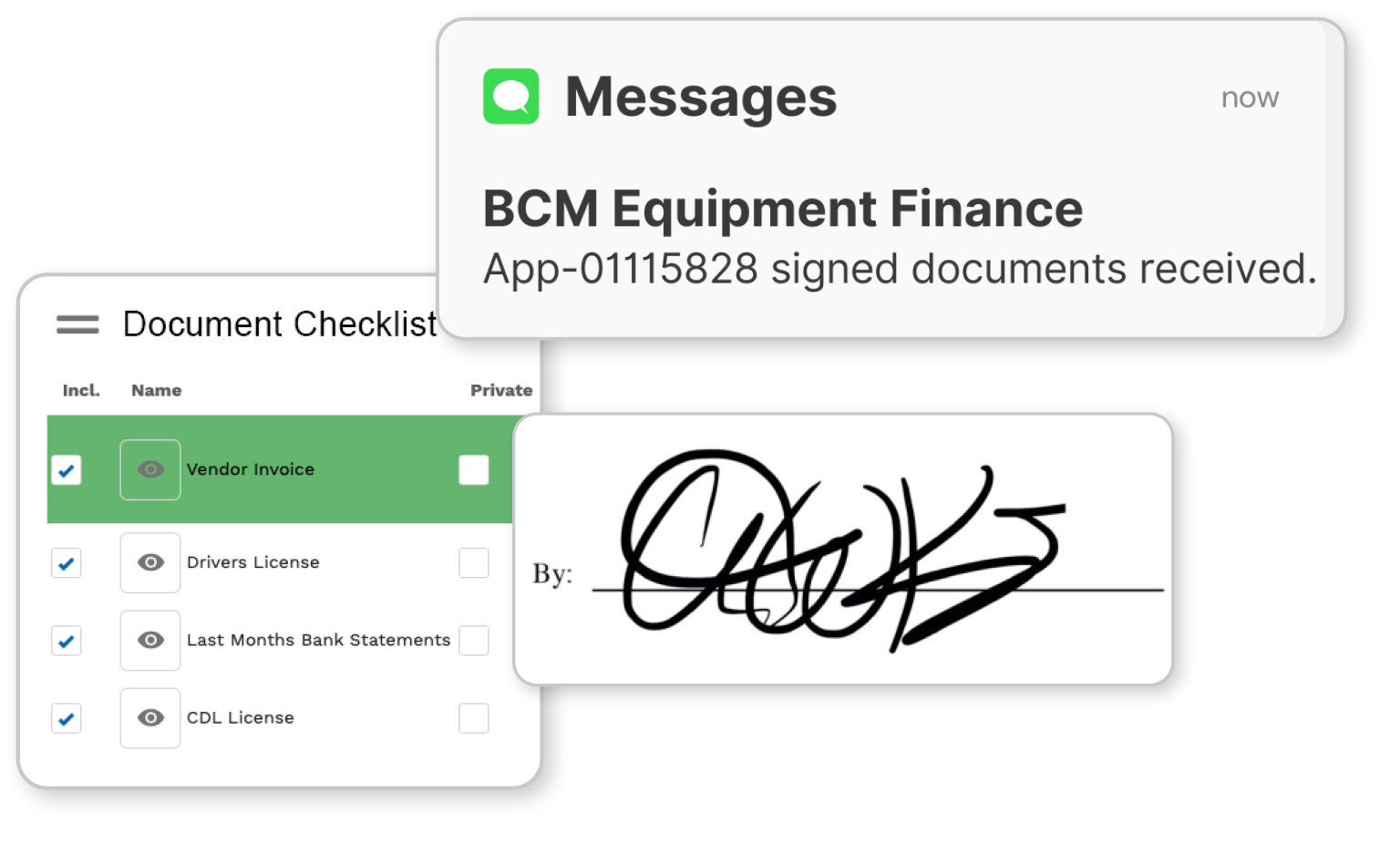

automated document generation

Instantly create and send documents so your customers can sign them anywhere, any time.

- eliminate data re-entry and human error

- real time updates & notifications

- all major e-signature providers supported

- quickly customize documents based on each customer’s unique needs

- seamless notarization integration

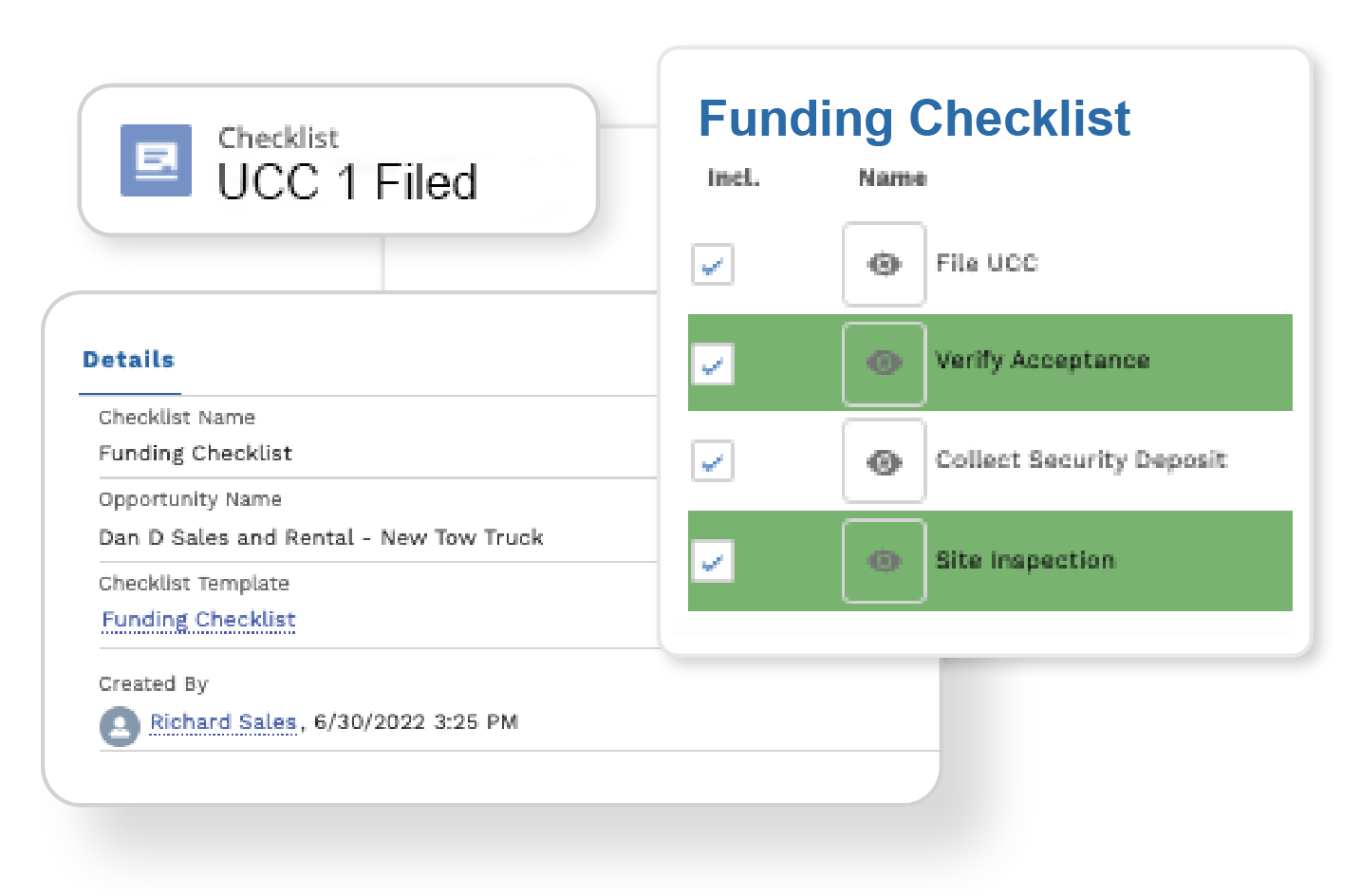

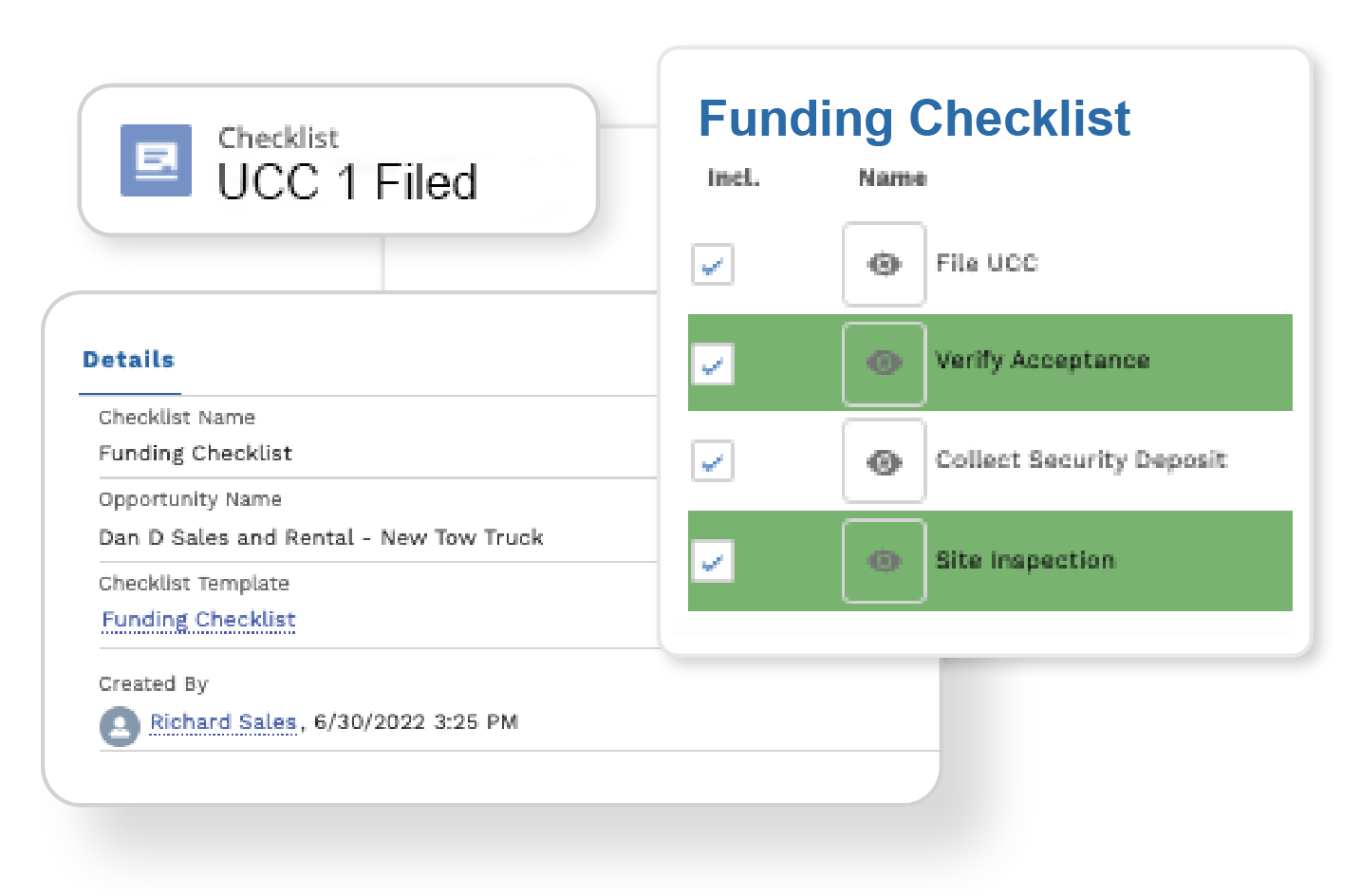

turn opportunities into

funded transactions faster

Have confidence knowing your customer data is accurate and verified before transactions are funded.

- eliminate fraud, know your customer at every stage of the process

- syndicate with any source

- efficiently manage titles, UCC filings & searches

- securely communicate and collaborate with your partners

- system-generated funding audit checklists

seamlessly sync your systems

Make servicing clients simple by storing all of your data in one place.

- book directly with your servicing system

- ensure accuracy and integrity of customer data throughout the entire lending experience

- seamlessly sync exposure and payment history between systems

- anticipate your customer’s needs with insightful, actionable customer overviews

- integrate with dozens of core banking and servicing systems

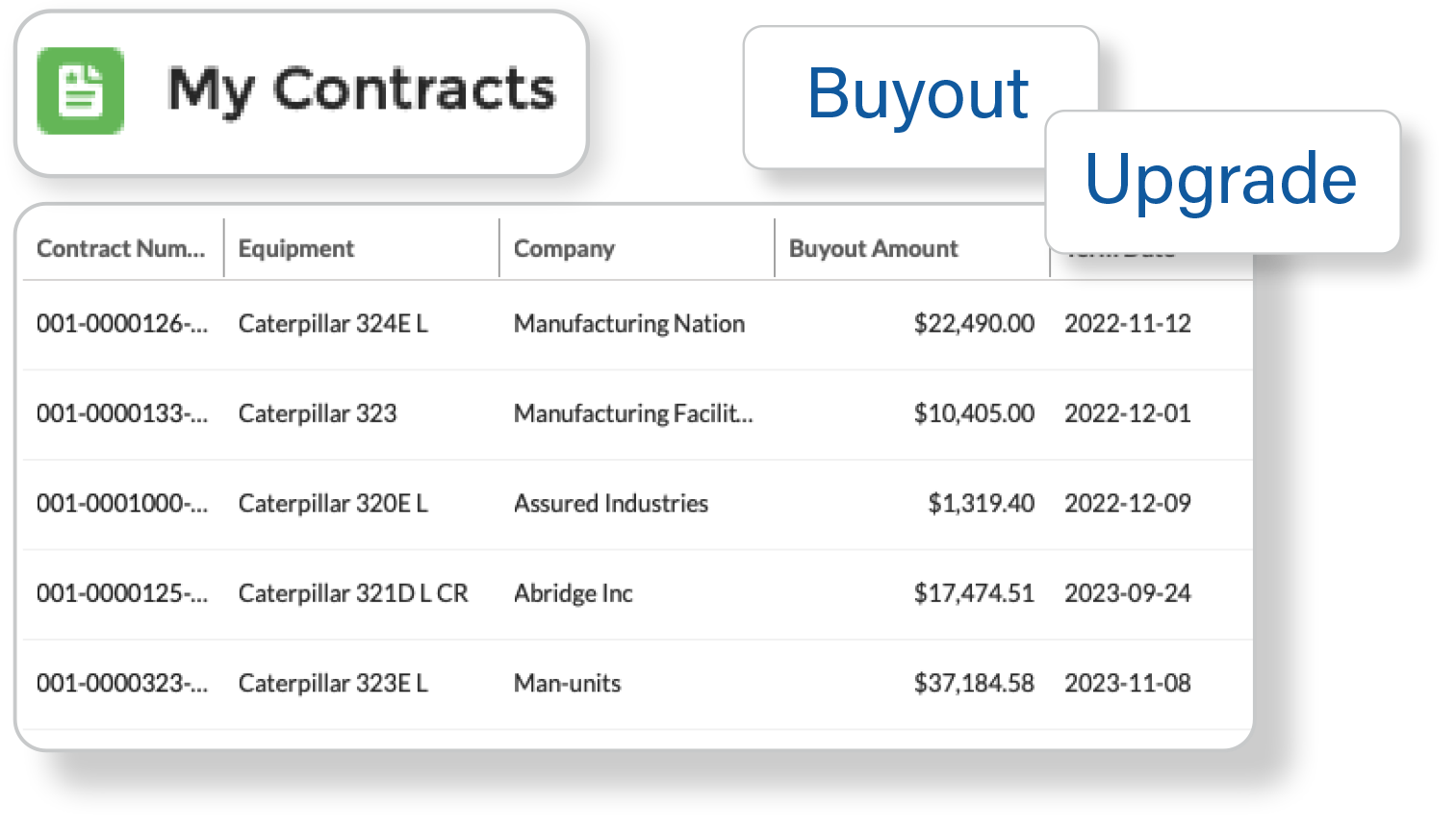

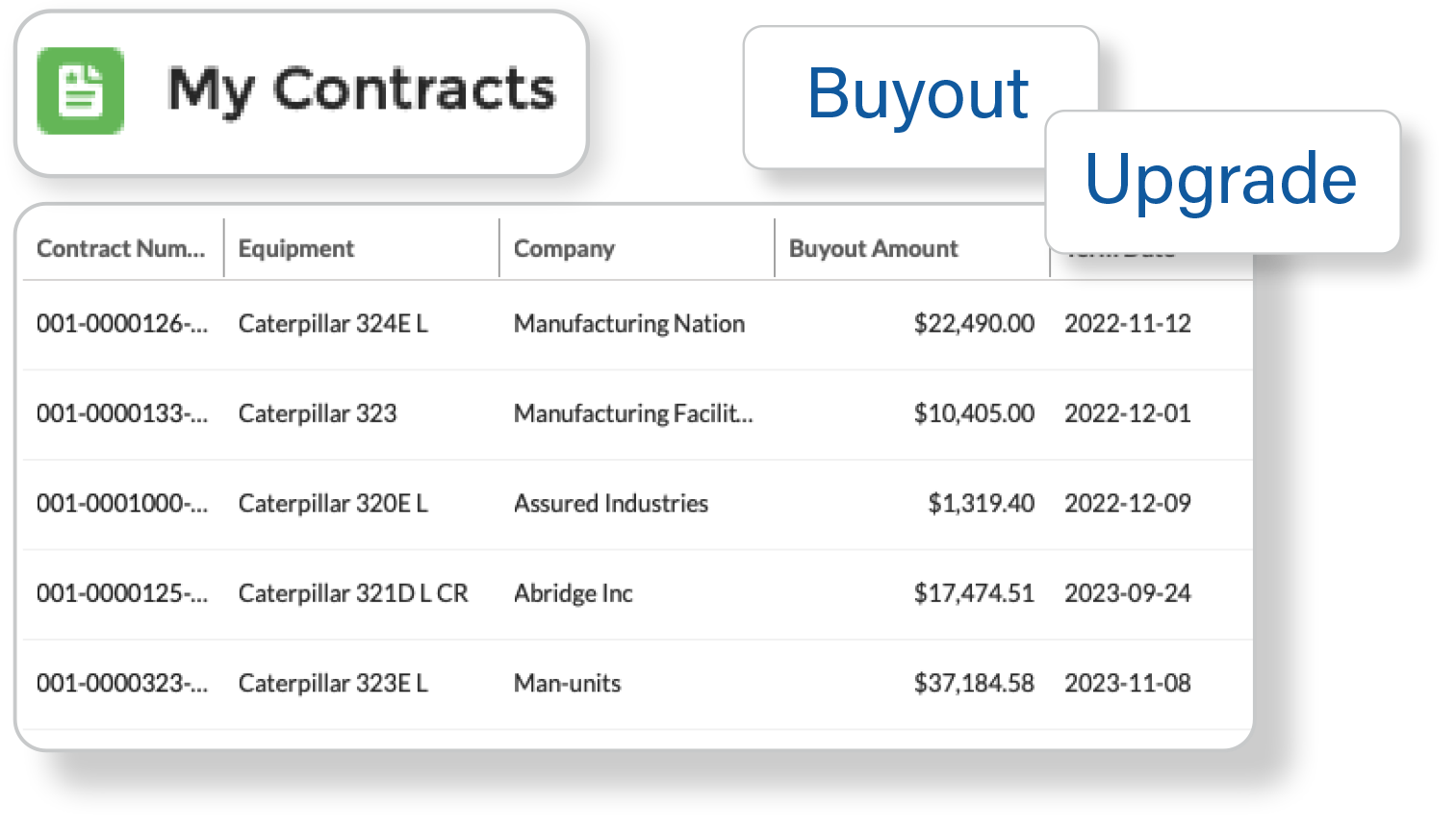

Don’t think you need the full aurôra LOS?

Aurôra’s portals can help you scale your business.